Renters Insurance in and around Salt Lake Cty

Your renters insurance search is over, Salt Lake Cty

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or house, renters insurance can be the most sensible step to protect your stuff, including your TV, golf clubs, books, pots and pans, and more.

Your renters insurance search is over, Salt Lake Cty

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Bekka Carlson can help you generate a plan for when the unexpected, like a water leak or an accident, affects your personal belongings.

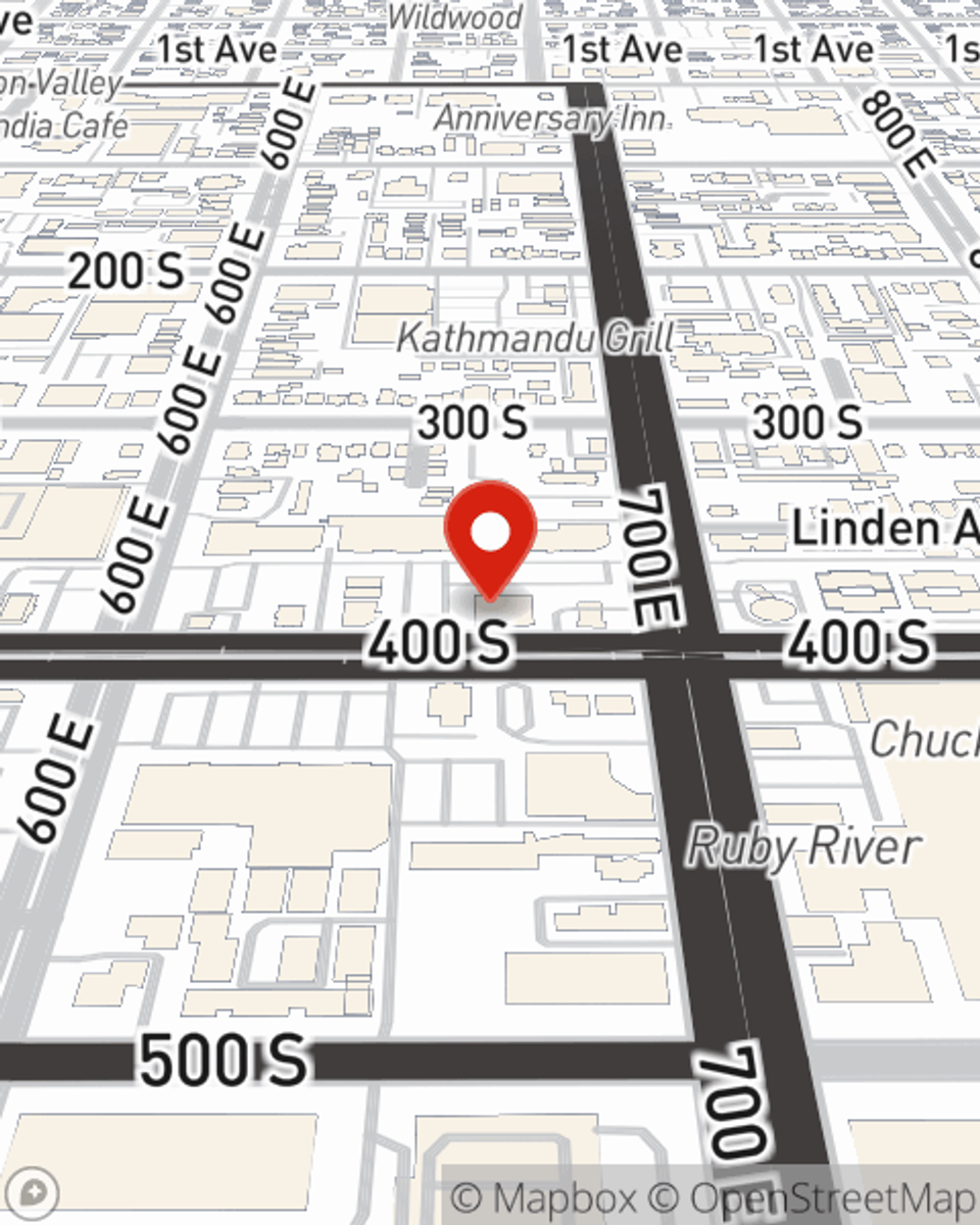

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Salt Lake Cty. Call or email agent Bekka Carlson's office to discover a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Bekka at (801) 533-8811 or visit our FAQ page.

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Bekka Carlson

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.